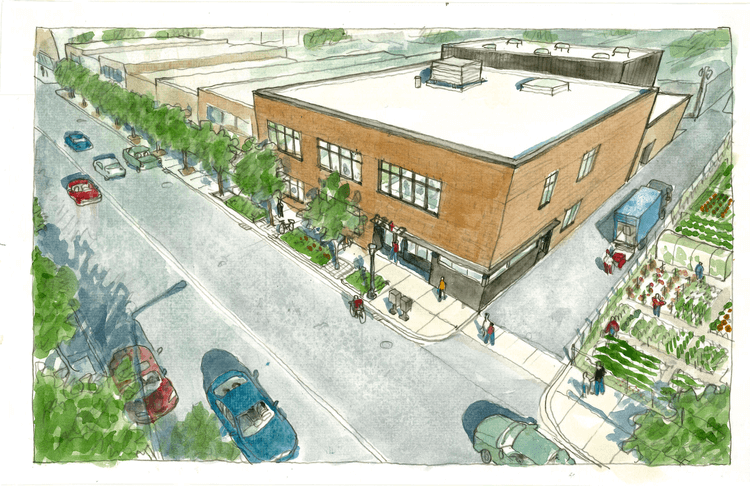

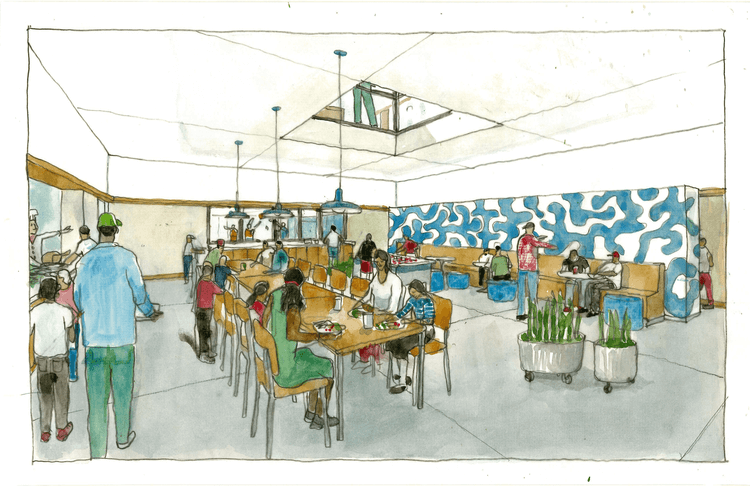

Capital Investment

House of Hope Community Center

We make no small plans! The House of Hope Community Center is our next step in the growth of C24/7’s services to the Rogers Park community.

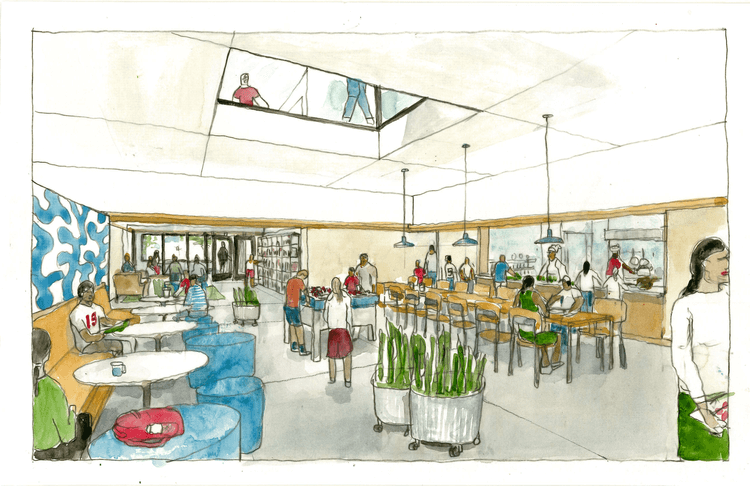

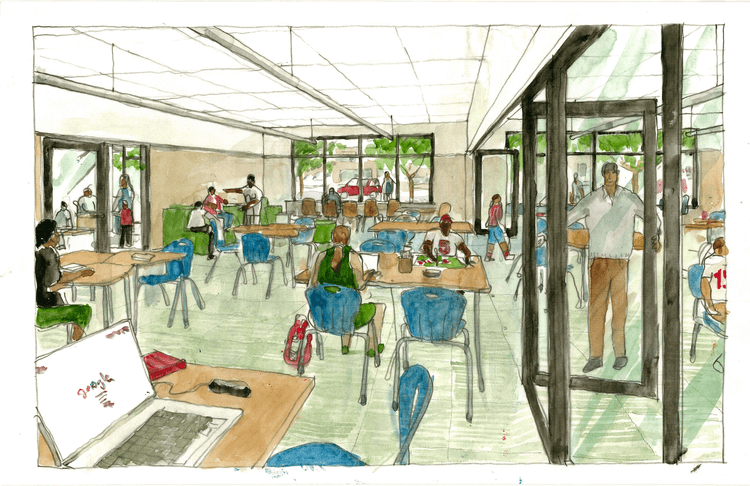

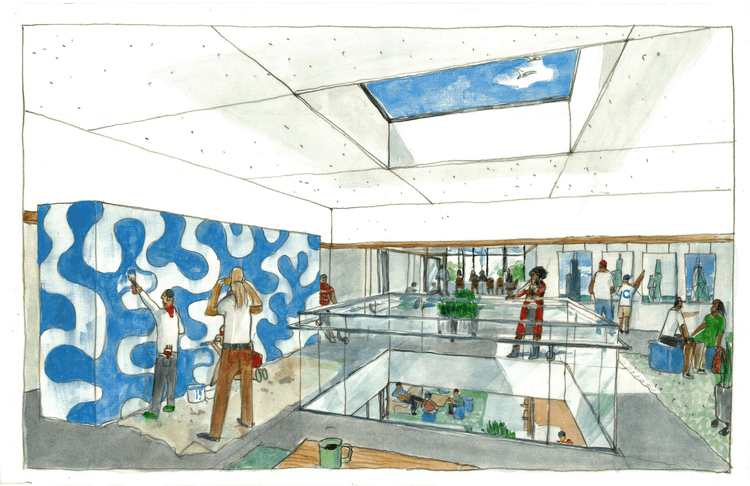

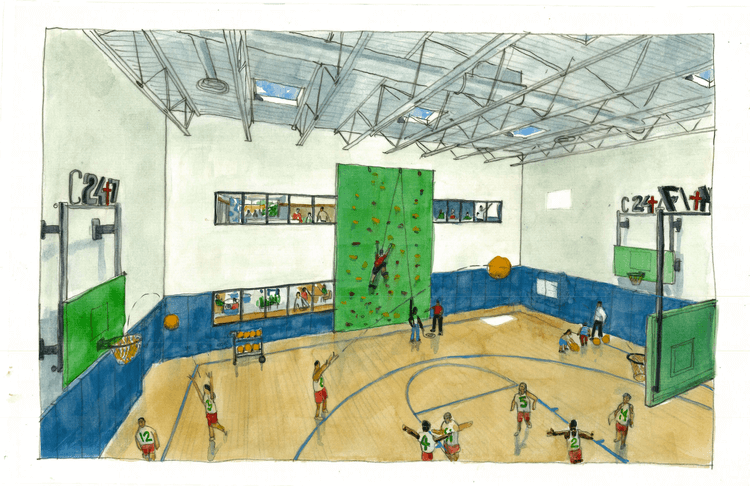

Tour Our Vision for the New Facility

Click through to take a virtual tour of renderings of our new facility.

Ways to Give

If you’re interested in exploring or learning more about any of these planned giving methods to support C24/7, please contact our Director of Advancement, Sheri Gibson.

Contact Sheri

Gifts of Appreciated Assets

Donors can simply transfer assets such as stock, land, or other property to C24/7, which avoids capital gains tax and offers an income tax charitable deduction.

Qualified charitable distribution

A great option for any donor aged 70 1/2 or older. Distributing money from a qualified retirement account directly to C24/7 avoids the taxations typically associated with distributions, while also leaving a gift to a great cause!

Donor Advised Funds & Family Foundations

If you or someone you know already have a Charitable Giving Fund and/or Family Foundation set up, you can choose C24/7 as a recipient of funds. Typically this is as easy as providing our EIN number: 81-3116501.